Distribution

payments

made easy

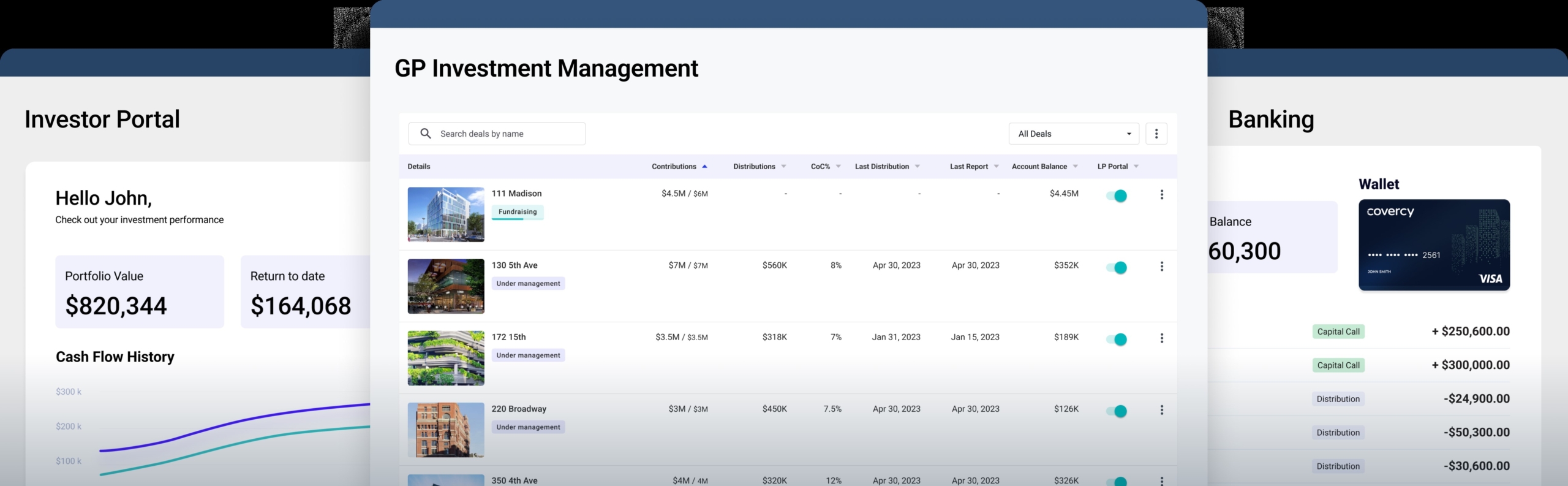

Distribute payments directly to your investors’ accounts – all within a single platform – only with Covercy.

|

Covercy launches AI |

We’ve just launched a new feature to enhance your experience.

Distribute payments directly to your investors’ accounts – all within a single platform – only with Covercy.

Distribution Payments 101

When it comes to making distribution payments, most GPs care most about keeping investors happy. Covercy built distribution payment features with that end goal in the forefront. Covercy’s payment tools empower GPs to connect and fortify LP relationships each time a distribution is made. With Covercy, that means three things: speed, reliability, and convenience.

Speed: Investors want to receive their payments as quickly as possible. Delayed or late payments can be frustrating and can cause investors to lose faith in the investment or the investment manager. Covercy’s end-to-end tool integrates bank accounts, which means distribution payments happen instantly. No more waiting for a paper check to arrive in the mail, a wire to go through, or an EFT to clear.

Reliability: Investors want to be sure that their payments will arrive on time and in the correct amount. They want to be able to trust the investment manager to handle their funds responsibly and professionally. With manual processes and calculations done on spreadsheets, the likelihood of errors is high. Covercy’s automation features ensure that human error is removed from the process entirely, giving both GPs and LPs peace of mind that payments are correct to the cent.

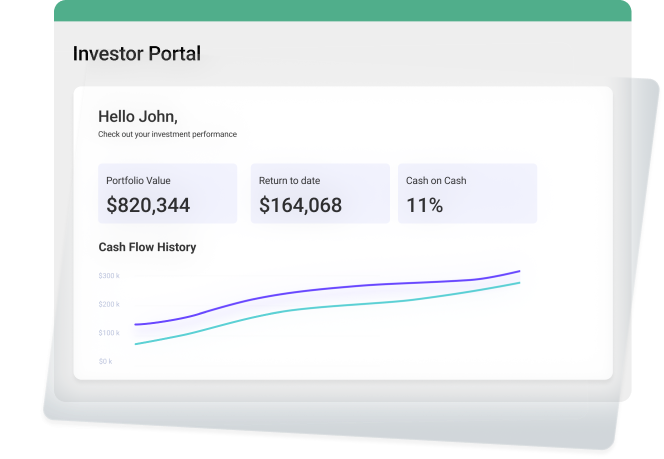

Convenience: Investors want to be able to access their payments easily and conveniently. They want to be able to choose their preferred payment method and have the flexibility to change it if necessary. Additionally, investors appreciate platforms that offer integrated payment solutions, which allow them to receive their distributions without having to leave the platform.

Investors also value transparency and communication from their investment managers regarding payment distribution. They want to be informed of the payment schedule and any changes in payment amounts or methods. By providing clear and timely communication, investment managers can build trust and foster positive relationships with their investors.

Distribution Payments:

A Brief History

The history of distribution payments to investors dates back to the early days of securities markets in the 19th century. During this time, dividend payments were typically made by issuing paper checks that were sent by mail to shareholders. The process was slow, expensive, and cumbersome.

Over time, the process of distributing payments to investors has evolved significantly, largely driven by advances in technology. In the 1970s, electronic funds transfer (EFT) became available, which enabled payments to be made more quickly and securely. However, it wasn’t until the 1990s that ACH (Automated Clearing House) payments became widely used for distributing funds to investors.

Today, ACH payments have become the standard for distributing payments to investors because they are faster, more efficient, and more secure than traditional paper checks. ACH payments can be initiated and processed electronically, which eliminates the need for physical checks to be printed, signed, and mailed. This not only speeds up the payment process but also reduces costs and errors.

Moreover, the rise of online investment platforms has made it easier than ever to distribute payments to investors. Many platforms now offer integrated payment solutions that enable investors to receive their distributions directly into their bank accounts without ever leaving the platform. This has made the process even more streamlined and convenient for investors.

Distribution Payments

the Covercy Way

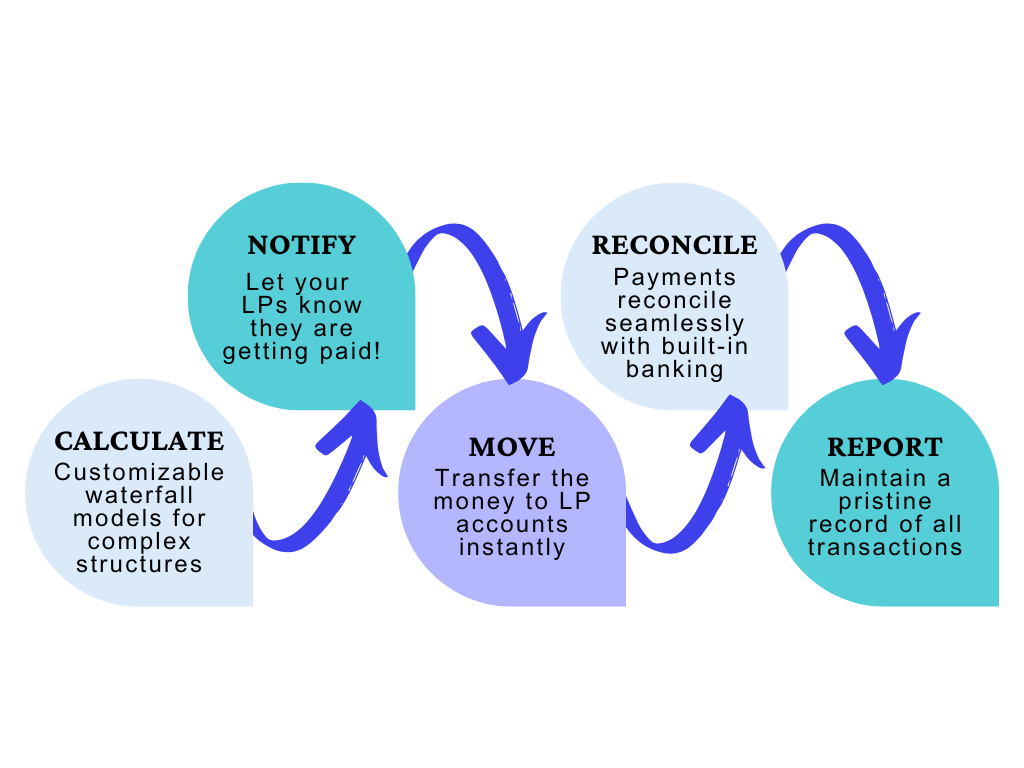

With Covercy, GPs can streamline the complex process of managing distribution payments to investors, saving time, reducing errors, and providing investors with greater transparency and insight into the performance of their investments. Covercy can help manage even the most complex waterfall distribution payments to investors in several ways. Here are a few examples:

Distribution Payments

in Real Estate

The nuances of making distribution payments to real estate investors can vary considerably compared to other types of investments, such as private equity or funds. Here are some key points of consideration:

Type of Investment: In real estate, the form of investment can range from rental properties, commercial properties, real estate investment trusts (REITs), etc. Private equity involves investments in private companies, while funds might include mutual funds, hedge funds, or exchange-traded funds (ETFs). The mode of distribution payments would vary based on the type of investment.

Frequency of Payments: Real estate investments, particularly rental properties, can provide consistent cash flow in the form of monthly rent payments, which can then be distributed to investors. On the other hand, private equity and fund investments usually distribute returns after a longer period, often after a successful exit event such as a sale or IPO.

Profit Distribution: Real estate profits are typically distributed as a percentage of rental income or property sales. In contrast, private equity or fund distributions can involve complex calculations involving carried interest, management fees, hurdle rates, and high watermark provisions.

Taxation: The tax treatment of distribution payments can vary widely. Real estate investors may have access to tax benefits such as depreciation or 1031 exchanges, whereas private equity investors may be subject to capital gains tax on their returns. The tax implications of funds vary based on the structure of the fund and the type of income it generates.

Liquidity: Real estate is generally less liquid than private equity or fund investments, which may affect the timing and size of distribution payments. While real estate often involves longer holding periods, private equity or fund investments may allow for more flexibility in terms of when and how returns are distributed.

Risk Profile: Real estate is generally seen as less risky compared to private equity or certain funds, but the risk profile of the investment will impact the expected return and consequently the distribution payments to investors.

Distribution Payments

Software

Software exists for both investment management and distribution payments, and some companies have successfully brought these feature sets together so they work as one.

Software features typically include ways to simplify the process of calculating and distributing profits to investors. It helps save time and reduce errors compared to manual processes and is particularly useful for real estate companies that have a large number of investors or properties to manage.

Investor Management: Maintain a database of investors, their contact information, their share in various properties, their preferred method of payment, and other relevant details.

Distribution Calculation: Automatically calculate distribution payments based on the parameters set by the user. These might include rental income, capital gains, expenses, and the specific structure of the investment (e.g., preferred returns).

Payment Automation: Automatically distribute payments to investors via their preferred method of payment (e.g., check, bank transfer, PayPal).

Reporting: Generate reports for investors showing the details of their distribution payments, including how the payments were calculated. It may also provide reports for management, showing the overall performance of the properties.

Tax Compliance: Prepare tax documents related to distribution payments, such as 1099 forms in the United States.

Communication: Send notifications to investors when distribution payments have been made, when new reports are available, or when other important events occur.

Integration: The software might integrate with other systems, such as accounting software, property management software, bank accounts, and more. This can save time by reducing the need for manual data entry.

Covercy offers several investment management software packages designed to scale and grow with you, including a forever-free version for up to three assets.

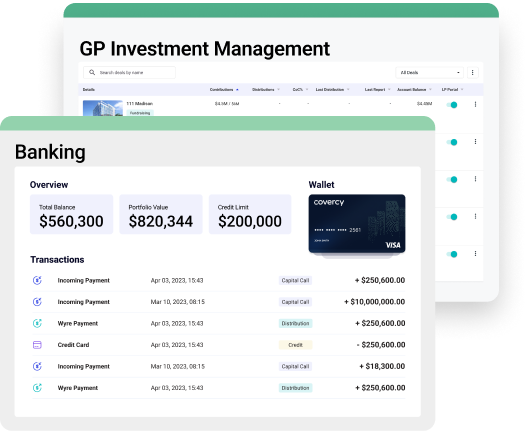

Covercy gives GPs and LPs a number of distribution payment advantages over other software solutions. With Covercy, GPs can calculate, execute and pay distributions with a few simple clicks.

Covercy users have access to powerful waterfall distribution models, which are completely customizable for each individual business case, and unlike most software solutions on the market, Covercy actually transfers funds from the GP or asset account to the LP account. Payments are available instantly and immediately reconciled with no additional fund administration work on the GP side.

Additionally, payments instantly reconcile for seamless & accurate reporting 100% of the time.

Commercial Real

Estate Syndication

Commercial real estate syndication is a way for multiple investors to pool their resources to invest in properties and projects much larger than they could afford individually. A syndicator (or sponsor) organizes the syndicate, finds the property to invest in, and manages the day-to-day operations, while investors contribute capital.

Distribution payments in real estate syndication follow a process similar to other types of real estate investments.

They represent the investor’s share of the profits from rental income, capital appreciation, or sale of the property. Here’s the general process:

Income Collection: The syndicator collects income from the property, such as rent from tenants.

Expense Payment: The syndicator pays all expenses associated with the property, such as maintenance or renovation costs, property management fees, mortgage payments, and taxes.

Distribution Calculation: The remaining income is considered profit and is distributed to investors. The distribution payment is typically proportionate to each investor’s share of ownership in the syndicate.

Distribution Payments: Payments are made to investors according to the agreed-upon schedule, often quarterly, but sometimes monthly or annually.

Preferred Returns: A common feature in syndication deals is the preferred return, or “pref”. This is a minimum return that investors are promised before the syndicator gets paid. It’s typically expressed as a percentage of the original investment, such as an 8% preferred return. If the property generates enough income, investors receive their preferred return before the syndicator takes any profit.

Profit Splits: After preferred return distribution payments are paid out, remaining profits are usually split between the syndicator and investors according to a predetermined ratio, such as 70/30, where investors receive 70% of profits and the syndicator receives 30%.

Waterfall Structure: Many syndications use a waterfall structure for distributing profits. This means that distribution rules change as certain profit milestones are reached. For example, the syndicator might receive a larger share of profits after investors have received a certain total return on their investment.

Capital Events: Large distribution payments often occur when the property is refinanced or sold. The distribution of these profits can follow complex rules, particularly if the syndication uses a waterfall structure.

Communication: Syndicators must maintain clear and regular communication with investors, which can be complex if there are many investors involved. This communication often includes regular reports on the property’s financial performance and updates on major events.

Legal and Regulatory Compliance: Real estate syndications are subject to a range of legal and regulatory requirements, particularly concerning how they are marketed and how investors are treated. Missteps can lead to legal trouble, making compliance a significant part of the syndicator’s responsibilities.

Given these complexities, many syndicators choose to use software or hire professionals to help manage distribution payments and other aspects of running a syndicate. As with any investment, it’s also important for investors to understand the terms of a syndicate deal before investing.

“Covercy has allowed us to streamline our investor interaction through their direct deposit distribution payments, document storage, and investor portal where investors can see their investment portfolio information regarding each asset.”

Not sure which is right for you?

Book a demo and we’ll help you decide.

*Covercy is a financial technology company, and is not a bank. Banking services provided by Thread Bank, Member FDIC.

The Covercy Visa Debit Card is issued by Thread Bank, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa is accepted.

**Your deposits qualify for up to $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://thread.bank/sweep-disclosure and a list of program banks at https://thread.bank/program-banks. Please contact customerservice@thread.bank with questions on the sweep program.

The Currency Cloud Limited (Non MIFID related products). Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199) Currencycloud Terms of Use All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Covercy Europe Limited. Registered in England No. 675000. Registered Office: 5 Elstree Gate, Elstree Way, Borehamwood, Hertforshire, WD6 1JD, UK

Covercy Technological Trading Limited. Registered in Israel No. 57797. Registered Office: 3 Ha-Yetsira St, Ramat Gan 5252141.

For clients based in the European Economic Area, payment services for Covercy Europe Ltd. are provided by CurrencyCloud B.V.. Registered in the Netherlands No. 72186178. Registered Office: Head office: Nieuwezijds Voorburgwal 296-298, 1012 RT Amsterdam. Currencycloud B.V. is authorized by the DNB to carry out the business of an electronic-money institution (Relation Number: R142701).

For clients based in the United States, payment services for Covercy Europe Ltd. are provided by Visa Global Services Inc. (VGSI), a licensed money transmitter (NMLS ID 181032) in the states listed here. VGSI is licensed as a money transmitter by the New York Department of Financial Services. Mailing address: 900 Metro Center Blvd, Mailstop 1Z, Foster City, CA 94404. VGSI is also a registered Money Services Business (“MSB”) with FinCEN and a registered Foreign MSB with FINTRAC. For live customer support contact VGSI at (888) 733-0041.

For clients based in the United Kingdom, Covercy Europe Ltd. is an EMD Agent of The Currency Cloud Limited. Payment and e-money services are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199).

We use cookies to ensure that we give you the best experience on our website. By using our website, you agree to our privacy policy.

OkWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Sadie Swisher

Sadie Swisher