Investor portals for commercial real estate differ from other types of investor portals in a few key ways. First, they typically include more detailed information about the properties being invested in. This can include things like property valuations, occupancy rates, and rent rolls. Second, they often offer more robust reporting capabilities, so investors can track the performance of their investments over time. Third, they may include features that are specifically designed for commercial real estate investors, such as the ability to manage capital calls and distributions.

Some additional factors to consider when choosing an investor portal software for your commercial real estate project:

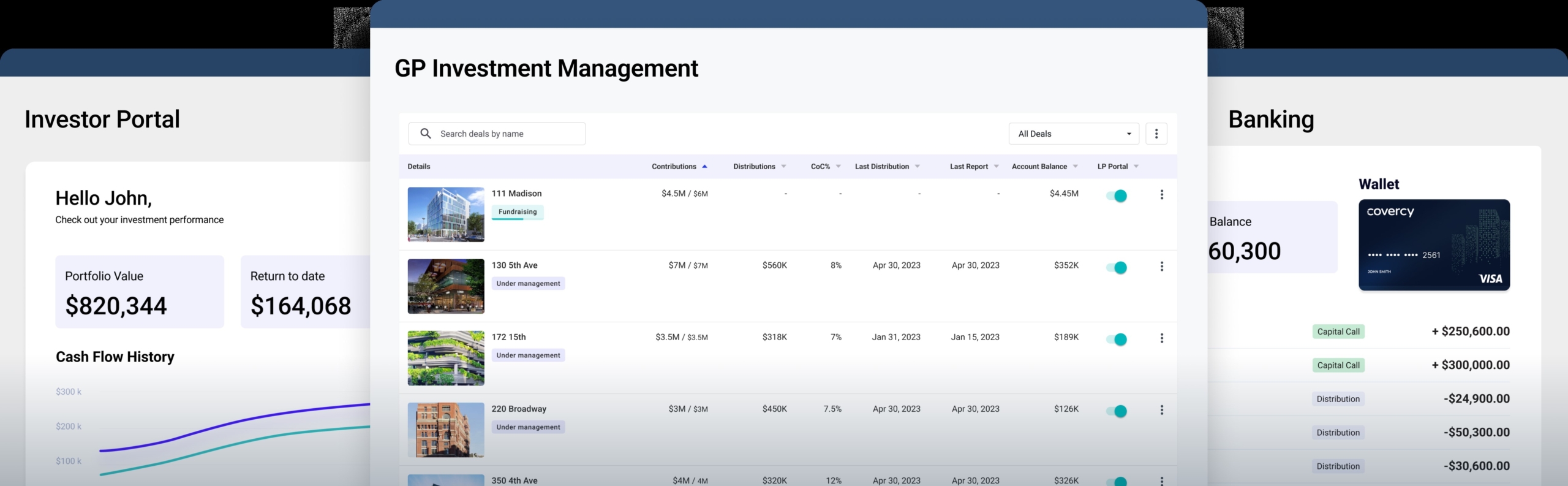

Property information: Investor portals for commercial real estate typically include detailed information about the properties being invested in. This can include things like property valuations, occupancy rates, and rent rolls. This information can be helpful for investors to assess the risk and potential return of an investment.

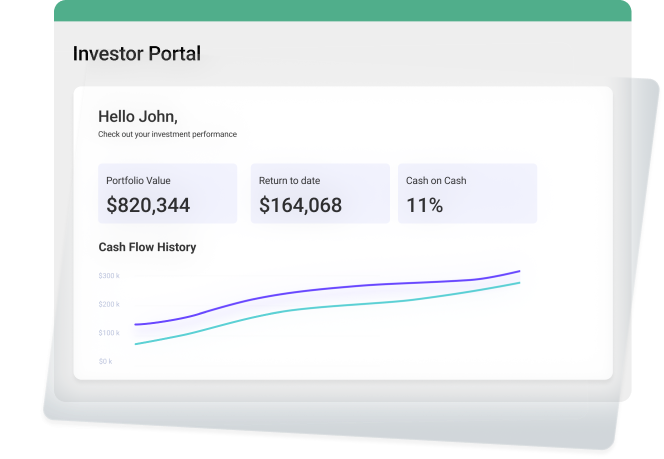

Reporting: Investor portals for commercial real estate often offer robust reporting capabilities. This allows investors to track the performance of their investments over time. Investors can use this information to make decisions about future investments.

Capital call and distribution management: Investor portals for commercial real estate may include features that are specifically designed for commercial real estate investors. This can include the ability to manage capital calls and distributions. This can help to streamline the process of raising capital and distributing profits to investors.